Crop biostimulants are many things. First, they are claimed to be multi-functional, including enhancement of soil and crop health, acceleration of soil nutrient cycling and improvement of crop productivity and fruit quality, among other benefits. Second, they are categorized by the active ingredient, application method, cost and target crops. Third, they are popular among ever-greater numbers of vegetable farmers regardless of production system, scale and commodity. Finally, some of their performance/efficacy is variable, while many others are unknown.

According to Grand View Research Inc., the global revenue generated by biostimulants was $1.74 billion in 2016, dominated by European and North American companies. Projections indicate that the market value will reach $4.14 billion by 2025.

Though it is difficult to obtain an exact number of biostimulant products currently on the market, the estimate is over 600 with more becoming available each year. However, this grand prosperity of crop biostimulants is not shared equally among people who use them. Particularly to vegetable growers who operate farming at every scale that differs widely in climates, production timing, marketable portion, planting techniques, field preparation and maturity, it can be extremely complex to choose the right product from the long list and use it at the right time in the right way. The first and maybe the foremost step toward a more effective use of crop biostimulants among vegetable growers is to understand their current use, experience, concerns and hopes. To accomplish the task, a survey was sent out to collect the specific information from vegetable growers mainly in the San Joaquin Valley and other counties in California.

The Survey and Respondent

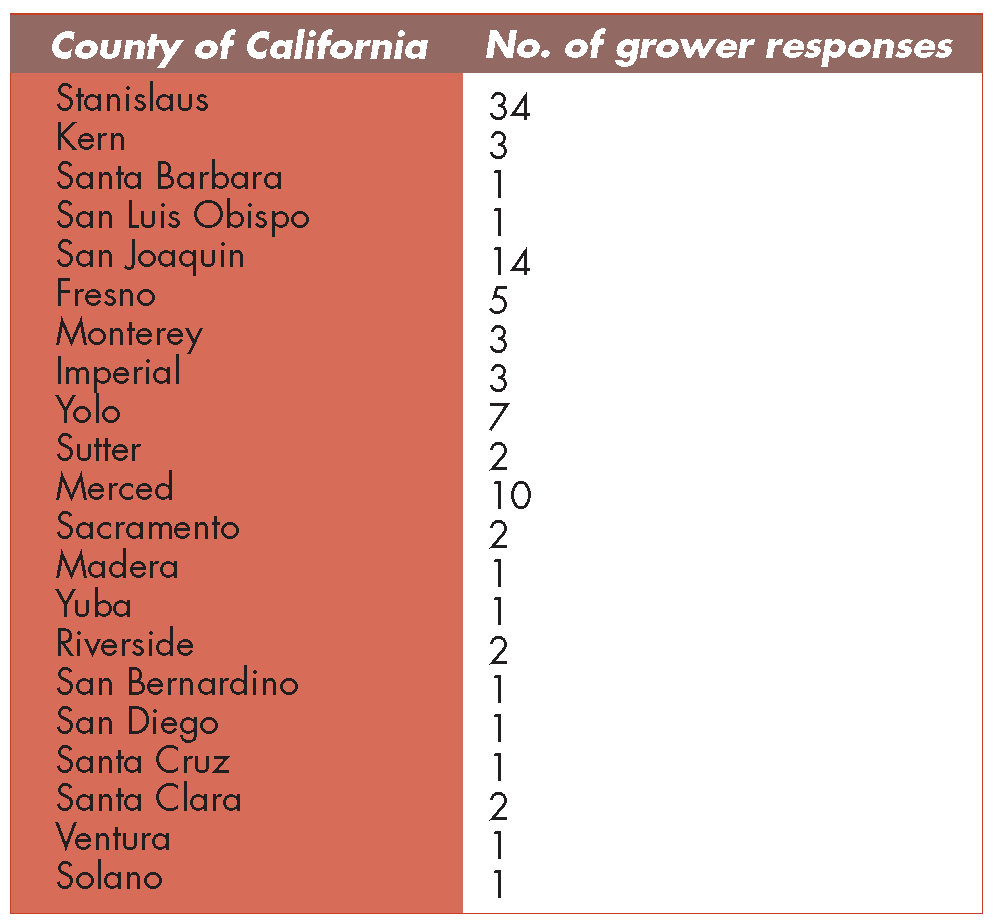

The survey was sent to approximately 648 vegetable growers in late October 2020 with the help of other UCCE advisors and commodity boards. The survey was then closed about two months thereafter before the responses were summarized. The original survey can be found at cestanislaus.ucanr.edu/Agriculture/Vegetable_Crops/Biostimulant_Survey/. The survey contains eight questions with the first four asking growers how they farm and the last four related to their experience and opinions to crop biostimulants. By the end of December 2020, we received a total of 83 responses (12.8%), with 74 of them being valid responses (11.4%). Nine responses were not included because there were two replies without an answer to any of the question, five responses from oversea, and two responses from counties outside California. Details about the composition and production of the 74 respondents are included below and in Table 1.

By production, there were 10, 27 and 37 growers claiming organic only, conventional only and mix of both.

By scale, there were 31, 7 and 36 growers with vegetable production scale below 100 acres, 100 to 500 acres and over 500 acres.

By commodity, crops with more than 10 responses included tomato (46), pepper (23), melon (21), summer/winter squash (21), leafy greens/herbs (21), cole crops (16), watermelon (16) and onion (13).

By production location, the 74 growers claimed to have their vegetable fields in 21 counties across California. For details, see Table 1.

Responses Regarding Biostimulants

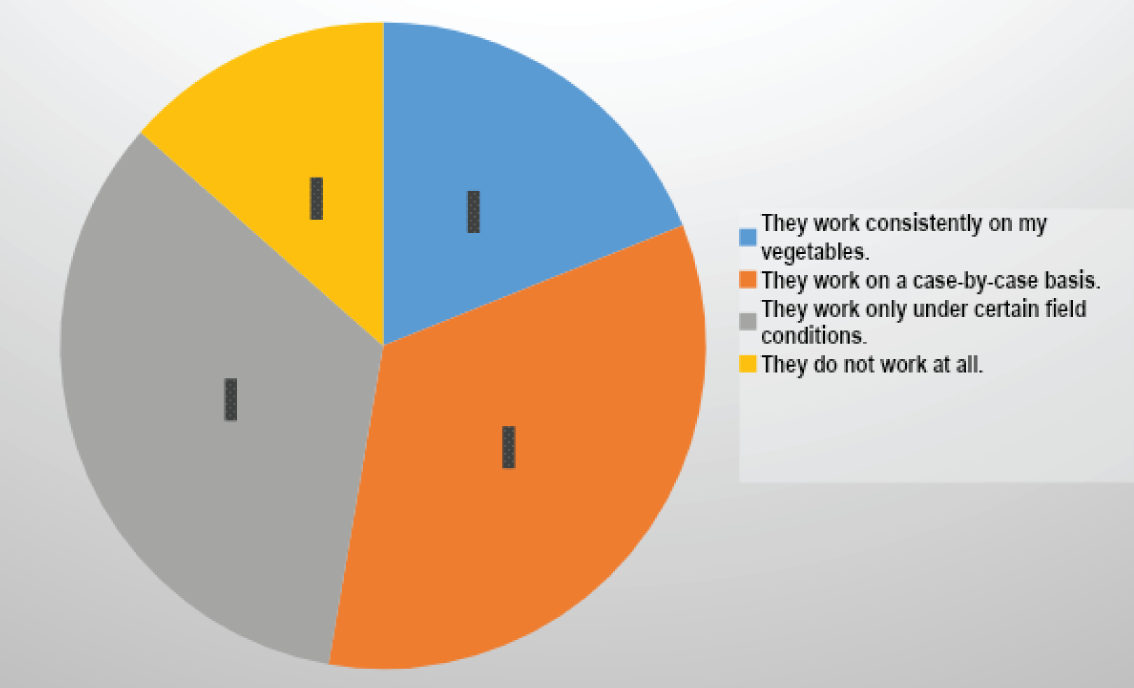

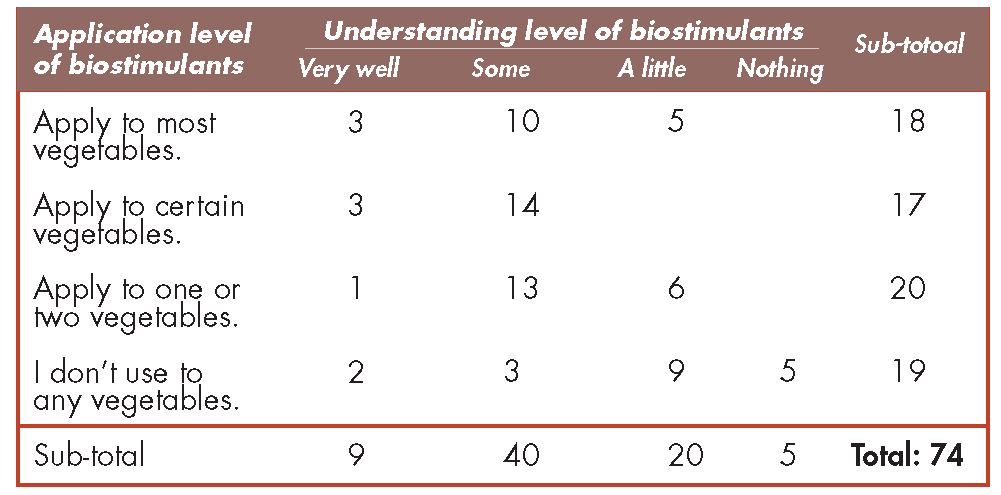

The responses indicated that over half of respondents (40) know some knowledge about biostimulants, of which 37 applied biostimulants to at least one or two of their vegetable crops. There were nine growers who claimed having the highest knowledge level (very well), but two of them did not use biostimulants to any of their vegetable crops. There is no surprise that the majority of growers who responded with just a little knowledge or not knowing anything about crop biostimulants did not apply any biostimulant to any of their vegetable crops. The respondents were almost equally distributed by the application level of biostimulants (Table 2). The survey also asked the previous experience or future impression regarding the efficacy of biostimulants on improving vegetable growth. From the results, 50 growers, representing 68% of total respondents, shared the experience or impression that biostimulants could conditionally confer their efficacy. Less than 20% of the respondents indicated a consistent, positive performance on improving their vegetable crops, while only 13% gave the negative impression on biostimulant efficacy (Figure 1).

Concerns and Hopes

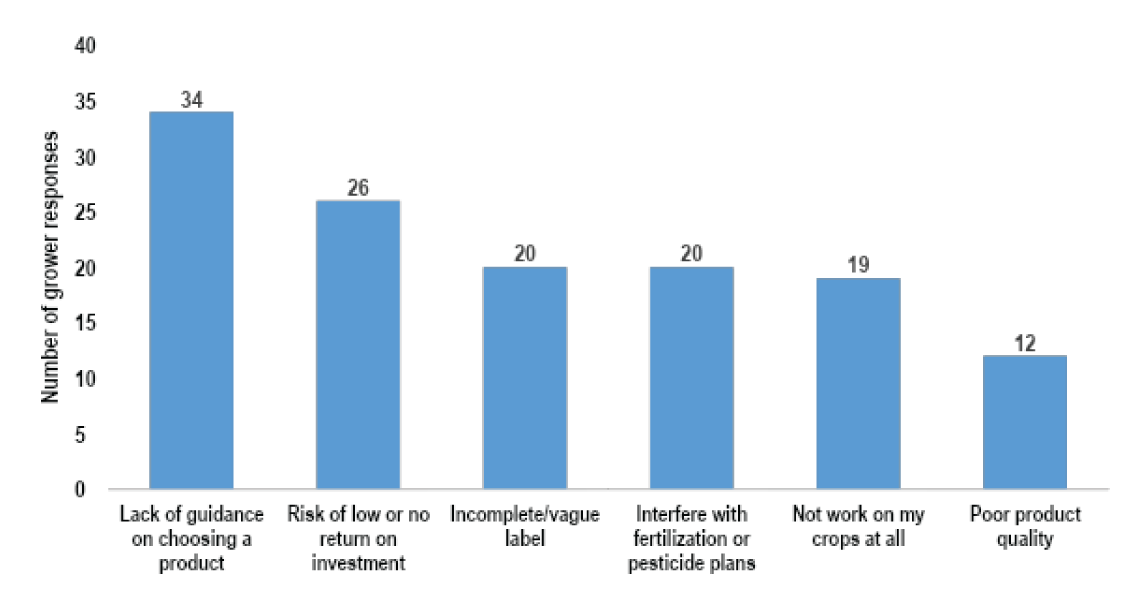

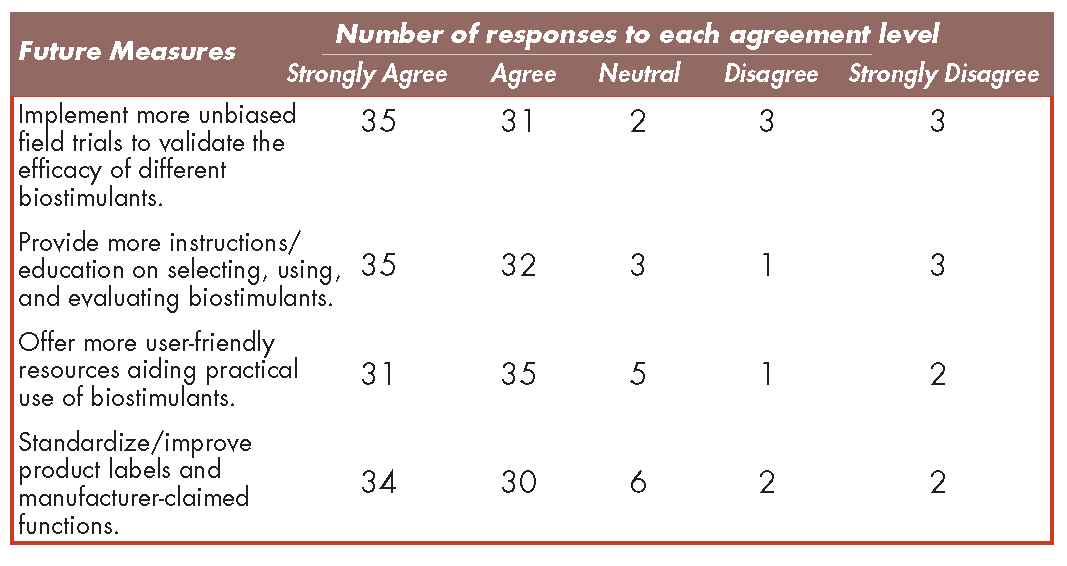

I have received numerous questions in the past years from vegetable growers, their advisors and colleagues regarding the biostimulant selection, effect evaluation, quality control and incompatibility with other field activities. “Going in blind”, “Unable to identify the benefits”, and “Snake oil” are common complaints. One of the main objectives for the survey is to identify the biggest concerns of using biostimulants on vegetable crops among growers. The survey results showed that about half of the respondents identified the difficulty of choosing a proper product as one of the main concerns followed by the risk of low or no return on investment. In addition, concerns of incomplete label and interference with fertilization and pesticide plans received 20 responses (Figure 2). Lastly, the survey asked growers their agreement level to future actions of improving the use of crop biostimulants. For all future measures, an average of 89% of the respondents agreed/strongly agreed that they will be helpful and important to improve future use of crop biostimulants (Table 3). These responses reflect the hopes from growers, and their voices should be heard by academia, industry, extension and other sectors to outline future efforts aiding a practical and profitable use of these biologics.

UCCE Biostimulant Testing Trials

The UCCE farm advisors from Stanislaus County are actively working with vegetable growers and biostimulant companies to conduct various testing trials each year. The main goal is to fill the data gap with more unbiased, statistically-viable product efficacy data on various vegetable commodities in the Central Valley. Since 2019, we have evaluated numerous biostimulants on processing tomato and watermelon productivity, fruit quality and plant health. Stay tuned to our newsletter and check for previous results (Veg Views: cestanislaus.ucanr.edu/news_102/Veg_Views/).

References

Biofertilizers Market Size, Share & Trends Analysis Report By Product, By Application, And Segment Forecasts, 2012 – 2022. grandviewresearch.com/industry-analysis/biofertilizers-industry.